When opening a company in Cyprus all investors pay special attention to taxation regulations. In Cyprus both individuals and companies are liable to income tax according to the Income Tax Law No. 118 issued in 2002. The income tax in Cyprus is paid for trade income, salaried services, pensions, interest, dividends, royalties and other incomes. Our Cyprus tax lawyers present below the main types of taxes imposed in this country.

Table of Contents

Tax base determination in Cyprus

In order to be levy taxes, the Cyprus authorities must first determine the tax base of a payer.

According to the local legislation, the taxation of an individual or company is made based residency. However, the criteria for each category of taxpayers are different.

In the case of individuals, taxation is determined on whether a person is a Cypriot tax resident or not. In order pay the personal income tax in Cyprus, a natural person must:

- have a Cypriot residence permit;

- live and/or work in Cyprus for at least 183 days within a calendar year;

- live in Cyprus for 60 days.

The 60 days rule is subject to additional requirements which imply:

- for the person not to live in another country for 183 days in a calendar year;

- for the individual not to be deemed a tax resident of another country;

- to live in Cyprus for the 60 days mentioned in the rule;

- have other ties in Cyprus.

The last criterion implies for an individual to have an office, be employed by a Cyprus company or run a business in here for at least 60 days in the 183 days timeframe.

Also, it must be noted that different tax considerations are applicable to company directors detached from other countries who can benefit from specific provisions contained by Cyprus’ double taxation treaties.

From a taxation point of view, natural persons considered Cypriot residents will be imposed with the income tax on their worldwide income. Non-residents will be taxed only on the income obtained in Cyprus.

When it comes to companies, these will be considered tax residents if they have a management place or office in Cyprus. Resident companies will be taxed on their worldwide profits, while foreign ones, will be imposed the Cypriot corporate tax only on the income generated in this country. However, these too can benefit from special clauses in double tax treaties. These usually refer to permanent establishments and associated enterprises.

Taxation in Cyprus is a very complex matter considering the authorities here also offer many incentives to stimulate investments. Our lawyers in Cyprus can offer detailed information on the tax legislation and its provisions related to foreign investments.

Income Tax in Cyprus

The income tax is applied to residents of Cyprus. A person is considered a resident if he or she is present on Cypriot territory for a period of time exceeding 183 days, therefore will be subject to the income tax from sources within Cyprus or abroad.

The Cypriot taxable income varies from 0% to 35 % depending on the income. The first 19,500 euros are tax-free and progressive rates apply for personal taxation up to a percentage of 35%. Personal deductions apply and they are possible through donations to approved charities, life insurance premiums, medical fund contributions or pension plan contributions.

Certain types of income can be taxed at different rates and the personal income tax is imposed on all kinds of business profits, discounts, pensions, rents, royalties, benefits in kind and others.

For pensions earned for services rendered abroad the income tax is set at 5 %.

Other taxes for individuals in Cyprus

Cyprus does not impose capital duty on individuals nor a capital acquisitions tax. Stamp duty and real property taxes do apply. Those who own a property in Cyprus must pay the annual tax imposed on the market value of the immovable property.

Social security contributions are payable both by the employer in Cyprus and the employee. The individual must pay 7.8% of his/her salary and self-employed individuals must pay 14.6%. Our Cyprus tax lawyers can give you more details about the taxation system in this country.

Tax compliance for individuals in Cyprus

The tax year in Cyprus is the same as the calendar year. Administrative penalties apply for the late filing of the tax returns as well as late submission of information requested by tax authorities. An employer in Cyprus has to submit the tax return by April 30 following the tax year for his or her employees. Different deadlines for filing apply for self-employed individuals and those who must also submit audited accounts.

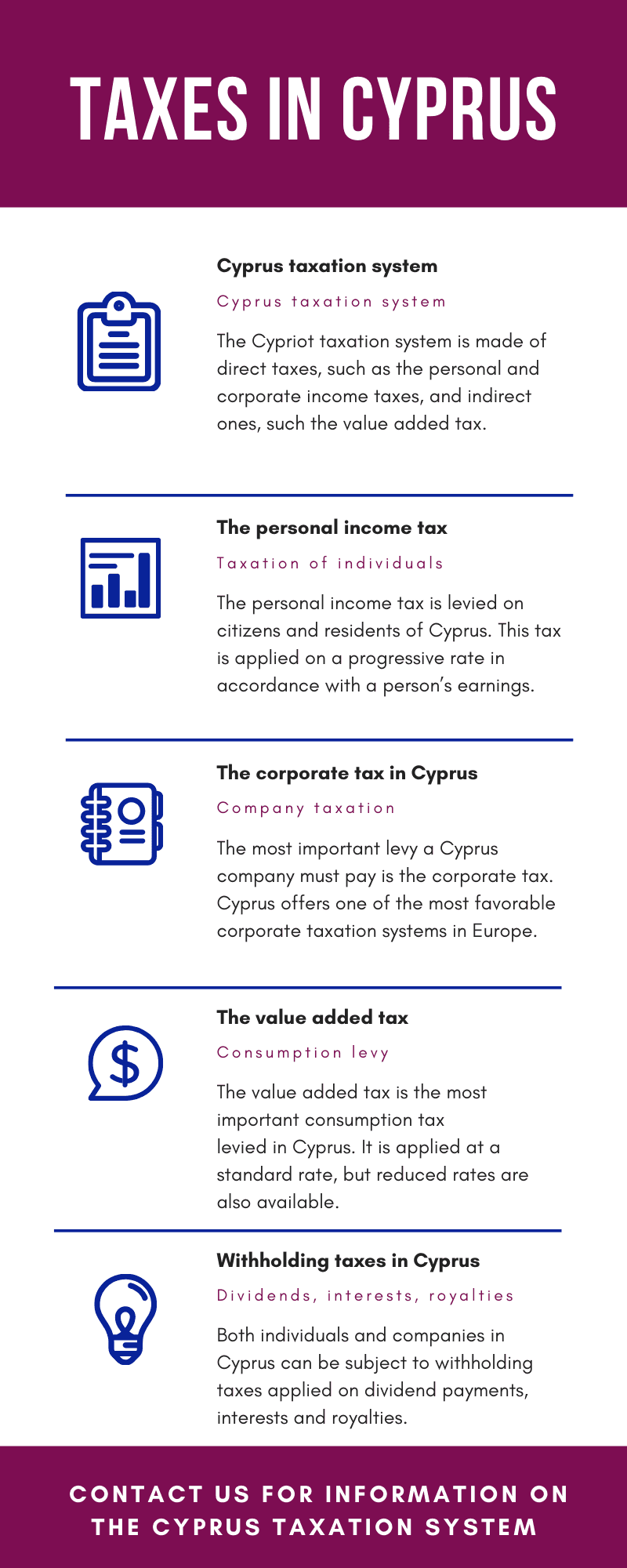

We have also created an infographic showing the main taxes to be paid in Cyprus:

VAT in Cyprus

In Cyprus, the VAT (value-added taxation) is applied on any service or product, as well as other types of transactions. Companies offering these products on the Cypriot market must register their business with the VAT District Office. Our Cyprus tax attorneys can help them register their companies for VAT. At the moment, the standard VAT in Cyprus is of 19%, but there are also reduced VAT rates of 9% for certain goods and services

The VAT rates in this country are as follows:

- A standard rate of 19%: is applied to product and service supplies which are not subject to the zero VAT rate, the reduced rate or are not exempt;

- The first reduced rate of 9%: it applies to:

- Catering and restaurant services;

- Accommodation in tourist establishments or hotels, as well as any other similar establishments;

- Passenger transportation and their luggage inside the country utilizing urban, rural and intercity taxis and buses;

- Travel of passengers in inland waters, as well as their luggage.

- The second reduced rate of 5%: applies to:

- The foodstuff supply;

- The supply of beverages, except for alcoholic drinks;

- Certain pharmaceutical product and vaccines supplies;

- Animal supply for the food preparation;

- Newspapers, books and magazines;

- Other types of services and products. Our Cyprus tax lawyers can offer more information on what they may consist of.

- The zero rate (0%): is applied to:

- The product exports;

- Modification, supply, repair, chartering, maintenance and employment of sea vessels, in certain conditions;

- Modification, supply, repair, chartering, maintenance and employment of aircrafts, in certain terms;

- Passenger transportation from Cyprus to a foreign country;

- Gold supplies to the Central Bank of Cyprus, and others.

We can assist trading companies in obtaining EORI numbers with the Cyprus Customs.

Corporate tax in Cyprus

The corporate taxation in Cyprus is applied on all resident companies on their income gained or derived from all sources from inside the country and from abroad.

The corporate tax in Cyprus for all business organizations is 12.5%.

Cypriot withholding taxes

The taxation system applicable in Cyprus states that the withholding taxes available here are not imposed for the following:

- dividends;

- interests;

- royalties.

This is applicable in the situation in which such payments refer to transfers to non-residents in Cyprus.

In the situation in which royalties are deriving from Cyprus, the taxation legislation stipulates that the withholding tax will be imposed at the standard rate of 10%. However, investors performing activities in the film industry will be imposed with a withholding tax on royalties applicable at the rate of 5%.

An important aspect related to the payment of withholding taxes on royalties refers to the fact that the tax can be eliminated under the stipulations of the double taxation treaties signed by Cyprus.

The regulation is also available under the European Union’s (EU) Interest and Royalty Directive, on which our Cyprus tax lawyers can offer more legal information.

Other types of withholding taxes in Cyprus

Non-residents performing business activities in Cyprus will be imposed with a rate of 10% on technical services. However, the investors can be

exempted from paying this tax if their services are provided through a permanent establishment. Companies operating in the field of public entertainment (which can refer to theatres or sports club) will be imposed with a 10% withholding tax rate on the gross income.

The activities carried out by non-residents in Cyprus related to the exploitation and extraction of continental shelf will also be required to pay the

withholding tax applicable at the rate of 5%, as long as the respective activity does not derive from a permanent establishment.

Businessmen are invited to contact our Cyprus tax attorneys for more details on the Cypriot taxation system available in the case of withholding taxes.

Taxation of foreign companies in Cyprus

In 2003 Cyprus modified its legislation regarding the taxation of companies by abolishing the distinction between domestic companies and foreign ones. Tax residency of companies in Cyprus depends on where the management is established and control of the company is located. Even if there is no specific definition regarding the management and control of a company in the Cypriot Commercial Code, the two terms refer to where the board meetings take place. Permanent establishments of foreign companies include the registration of an office or a branch in Cyprus for periods longer than three months.

Tax exemptions and deductions for foreign companies in Cyprus

Foreign companies, like Cypriot companies will benefit from the following exemptions from the corporate tax:

- the income earned from interests,

- incomes earned from dividends,

- incomes earned from the disposal of securities.

Interests earned from open-ended or closed-ended collective investment schemes in Cyprus are not exempt from taxation.

Foreign companies are taxed on the profits earned by their permanent establishments in Cyprus. The corporate tax rate in Cyprus is 12.5%, which is also among the lowest corporate taxes in Europe at the moment. Unlike local companies, foreign companies cannot benefit from the double taxation agreements Cyprus has with other countries. Companies are also subject to a Special Contribution for Defense (SCD), also called the Defense Tax that applies to dividends, interests and rental of properties in Cyprus.

Other taxes that need to be paid by Cypriot companies

Apart from the corporate tax, companies registered in Cyprus must also pay other taxes in accordance with the activities they undertake. For example, trading companies importing goods into Cyprus are subject to custom duties. These are imposed based on the nature of the goods and the codes imposed by the Customs Authority.

The sale of goods such as petroleum, tobacco, alcohol, and transportation means are also subject to excise taxes. Stamp duties are also imposed on companies on various assets located in Cyprus.

The capital duty imposed on the authorized share capital of companies has been abolished a few years ago.

It should be noted that immovable property transfers are imposed with a transfer tax that is collected by the Land Registry in Cyprus. The rates depend on the market value of the real estate.

The defense tax in Cyprus

The Cypriot defense tax is a special contribution people have to pay for unearned income sources such as dividends, bank interests, incomes from rents. The percent for this tax varies between 17 and 30 percent depending on the source of income. The defense tax is imposed according to the Special Contribution for the Defense of the Republic Law No. 117, issued in 2002.

The rates of the Defense Tax are as it follows:

- dividends are taxed with 17%,

- interests are taxed with 30%,

- rentals are taxed with 3%.

The capital gains tax in Cyprus (CGT)

The capital gains tax in Cyprus is imposed on earnings on immovable properties, shares on companies with immovable properties included. This rate is set at 20 percent. The tax is imposed according to the Capital Gains Tax Laws 1980-2002. For more information our Cypriot lawyers will remain at your disposal.

Immovable Property Tax in Cyprus

The immovable property tax in Cyprus has been abolished starting with 1 January 2017 for the 2017 tax year, as well as the following year.

Our Cyprus tax lawyers will provide you with the best legal advice regarding all Cypriot taxes.

Foreign tax reliefs in Cyprus

As mentioned above, Cyprus is a country that is worth investing in as the authorities here have created a legal framework that supports foreign entrepreneurs and tax reliefs are very appreciated.

According to the local legislation, Cyprus offers tax reliefs through double tax treaties or through a unilateral decision to residents who earn income outside the country and who pay taxes in the countries where the income was obtained. The condition to benefit from this rule is for the foreign tax to be equal or lower to the tax that would be paid in Cyprus.

Cypriot employees can also benefit from other incentives under the form of reimbursements for business-related travel. Also, pensions obtained outside Cyprus are taxed at a flat rate of 5% only on amounts exceeding 3,420 euros. Any sum up to this amount is exempt from taxation.

Tax lawyers in Cyprus

Cyprus is one of the most appealing countries in Europe and the European Union when it comes to the taxation of individuals and companies, however, in order to benefit from the advantages it offers, a deep understanding of the legislation is mandatory. This is why the assistance of a tax lawyer is recommended.

Our Cypriot lawyers are up to date with the latest changes in the legislation related to taxes and can help you apply for any incentive provided that you meet the required criteria. We can also help natural persons who decide to move to Cyprus based on residency or citizenship by investment and who can benefit from special regulations.

Please contact us for further information.