The financial system in Cyprus has developed quite a lot in the last few years, making it easy for individuals and companies in need of innovative services to actually benefit from them. One of the most common financial operations is related to various types of transactions, however, one must have a bank account in order to be able to transfer money.

Nowadays opening a bank account in Cyprus has become a simple and rapid procedure. The Cypriot banking system has undergone a massive change that led to its development. Opening a Cypriot bank account implies little time and an easy procedure for both individuals and companies. Most Cypriot banks provide a wide range of services.

Our Cypriot lawyers can offer more information on the requirements related to opening various types of bank accounts in this country. We can also assist with the procedure of setting up a business in Cyprus, which implies having a corporate bank account with a local institution.

Table of Contents

The banking system in Cyprus

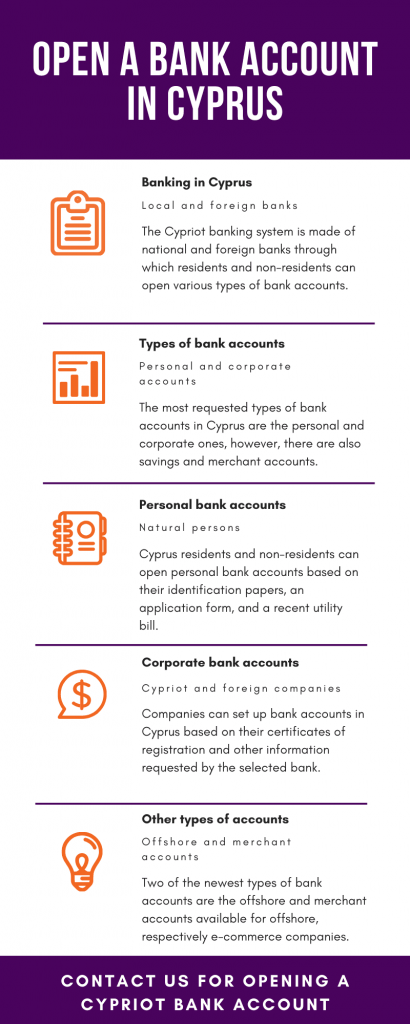

The Cypriot banking system is made of the National Bank which authorizes the other banks operating in the country, but also supervises their activities. With respect to the types of banks operating in Cyprus, these are private national banks, but foreign banks also operate through branches and representative offices.

There are several local and foreign banks operating in the entire country at the moment. Those who want to open bank accounts in Cyprus have plenty of options from this point of view.

You may rely on us if you want to open a bank account in Cyprus. We have helped clients with a variety of activities over the years thanks to our years of experience, including setting up various accounts for either personal or professional use. Get in touch with us to learn how to set up the account you need and to obtain the data you desire.

| Quick Facts | |

|---|---|

| Types of bank accounts |

Personal, employment, corporate, savings, offshore, |

|

Document requirements for natural persons |

Valid ID/passport, application form, recent utility bill, Cypriot residence permit or other documents issued by the Cypriot authorities |

|

Documents requirements |

Articles of Association, information about the company representative, proof of legal address in Cyprus, application form are required to open a bank account in Cyprus |

| Address requirements for foreign citizens (YES/NO) |

YES, foreign citizens must submit a recent utility bill to open a bank account in Cyprus |

| Requirements to travel to Cyprus (YES/NO) | NO, a local representative can be appointed to create the account |

| Remote bank opening possibility (YES/NO) |

YES, it is possible to open a Cypriot bank account remotely |

| Timeframe for opening the bank account (approx.) |

Approx. 2 weeks |

| Legal representative requirement (YES/NO) | No, however, one can be appointed when the account is created remotely |

| Services attached to the accounts | Debit and/or credit card, access to financing and loans, money transfer |

| Types of banks to open accounts with | Local and foreign banks |

| Merchant bank account availability (YES/NO) | YES, e-commerce companies can open merchant accounts in Cyprus |

| Foreign currency availability (YES/NO) | YES, it is possible to open a bank account in another currency |

| Access to online banking services (YES/NO) | YES |

| Advantages of a Cypriot bank account | Quick set up procedure, access to numerous banks, possibility to open offshore bank accounts |

| Bank account opening service availability (YES/NO) | YES, we can assist with the creation of onshore and offshore bank accounts in Cyprus |

| Eligibility | Any individual or legal entity can open a bank account in Cyprus. |

|

Minimum deposit |

The minimum deposit requirement varies depending on the bank and account type. |

|

Deposits and withdrawals |

You can make deposits and withdrawals through bank transfers, ATMs, and debit cards. |

| Interest rates | Banks in Cyprus offer competitive interest rates on savings and fixed deposit accounts. |

| Fees and charges |

Be aware of any account maintenance fees, transaction fees, or other charges that may apply. |

| Account protection |

Deposits in Cyprus banks are safeguarded through the Deposit Guarantee and Resolution of Credit Institutions Scheme (DGS). |

| Foreign exchange services |

Banks in Cyprus offer foreign exchange services for currency conversions. |

| Investment opportunities |

Cyprus banks may offer investment products such as mutual funds or structured deposits. |

| Tax considerations |

Understand the tax regulations and implications related to your bank account with the help of our lawyers in Cyprus. |

| KYC procedures | Banks follow Know Your Customer (KYC) procedures to verify the identity of their clients. |

| Financial stability |

Cyprus has a stable banking system regulated by the Central Bank of Cyprus for financial stability. |

| Online security measures |

Banks employ advanced security measures to protect online transactions and customer data. |

| Exchange control regulations |

With the help of our Cypriot lawyers, familiarize yourself with any exchange control regulations that may apply to your transactions. |

| Possibility of account closure |

You can close your bank account in Cyprus by following the bank’s specified procedures. |

| Additional services offered by our team of lawyers | Yes, assistance for creating merchant accounts or any other types of bank accounts. |

When it comes to choosing the bank to open an account with, it is good to know that most banks offer similar services, the main difference between them being the fees and other charges attached to different transactions completed with the respective bank.

It is also worth noting that in order to verify a bank, one can search it with the National Bank of Cyprus.

Our law firm in Cyprus can help foreign investors and citizens interested in setting up various types of accounts in this country.

You can read about how to open a bank account in Cyprus in the infographic below:

Who can open a bank account in Cyprus?

The National Bank of Cyprus allows both Cypriot and foreign individuals and companies to set up bank accounts in Cyprus for various purposes. No matter the type of bank account one needs, certain documents need to be submitted with the chosen bank. It is also important to know that both individuals and companies have total liberty in choosing the bank they want to work with.

Our law firm in Cyprus offers a wide variety of services to businesses and natural persons. We are at your disposal with tailored solutions adapted to your particular case. Do not hesitate to contact us and find out how we can help you obtain the results you seek in any legal matters.

Types of bank accounts which can be set up in Cyprus in 2024

Each Cypriot bank offers its own services, even if some may be similar. One of the common services offered by banks in Cyprus is the possibility of choosing the type of bank account to open. While individuals can open personal and employment bank accounts, companies can set up corporate bank accounts. There is also the possibility of setting up merchant accounts which can be used by e-commerce and other types of online businesses. One can also open a savings account in Cyprus. The latter is usually set up by those interested in wealth management solutions by keeping their pecuniary assets in a bank account.

Another category of bank account which is set up by those who open offshore companies in Cyprus is the offshore account.

How to choose the bank for opening an account

When choosing the bank to open an account with, there are various aspects that need to be considered. First of all, one should verify the conditions imposed by the respective bank. For example, those looking to set up personal bank accounts could be required to deposit a minimum amount of money upon the opening of the account. The services available once a person becomes of client of that bank are also not to be neglected and can represent an important aspect when choosing the bank.

Those who open companies in Cyprus should also consider the possibilities of making money transfers abroad, especially when they are foreign shareholders in the respective companies.

The access to online banking services is also important when opening a bank account in Cyprus, however, many banks offer such services. These services are important for those interested in completing various actions, such as transferring money from one account to another, making changes in the details of the account and others. However, certain actions are limited, and more important changes could imply personal visits to the bank. What is worth noting when opening a bank account in Cyprus is that local financial institutions have English-speaking personnel which makes communication easy.

Those looking to obtain loans should also check these facilities offered by a bank when choosing to open a bank account in Cyprus. Many times, the loans accessed with a bank one is client of benefit from lower interest rates.

There are many aspects which need to be considered when opening a bank account in Cyprus, and our lawyers can advise foreign citizens and companies on how to choose the bank. Moreover, those who want to open companies in Cyprus can rely on our lawyers for assistance in setting up the corporate and merchant accounts.

Open a personal bank account in Cyprus

When it comes to setting up a personal bank account, this can be created by an individual living in Cyprus or outside it personally, or it can be opened by a local company employing that person. This is usually created with the purpose of receiving the salary. There is no difference between a personal and an employment bank account, however, it is possible for an account created by a Cypriot employer to benefit from lower fees and commissions, as an understanding between the bank and the Cyprus company.

Information about the employment relation, in case the account is set up by the employer.

For an individual is quite simple and easy to set up a personal bank account in Cyprus. The documents one must submit for opening the bank account are:

- copy of a valid passport, identity card (some banks will require notarized copies of identification documents);

- an utility bill stating the residence address of the applicant (the bill cannot be older than 6 months)

- an application form issued by the bank;

Foreign citizens interested in opening bank accounts in Cyprus in 2024 will need their valid passports as identification papers.

Open a corporate bank account in Cyprus in 2024

The opening of a corporate bank account in 2024 remains mandatory when registering a company in Cyprus, as it is part of the incorporation procedure. At first, the corporate bank account is used for depositing the share capital of the future business, later on being used for business transactions.

The process of opening a corporate bank account in Cyprus is as easy as setting up a personal bank account except companies are required to provide more documents. In order for a company to open a bank account in Cyprus the following documents must be submitted:

- the Articles of Association, the Certificate of Incorporation and the Share Certificate of the company;

- a certificate of good standing for foreign companies if they have been opened for over 2 years;

- the Certificates of Directors and Secretary, the Certificate of the Registered Office;

- a proof of the registered office issued by the Group Principal Trading Offices;

- an application form released by the bank (each bank has its own model of application).

In order to open a bank account in Cyprus for a partnership the following documents must be submitted:

- the partnership agreement;

- the Certificate of Incorporation;

- proof of the registered office;

- a certificate of the partners;

- a certificate of good standing for foreign partnerships if they have been registered for over 2 years;

- an application form issued by the bank.

Our Cypriot lawyers can open various types of bank accounts based on a power of attorney.

When it comes to opening corporate bank accounts, our lawyers in Cyprus can help both local and foreign investors interested in doing business here.

Opening merchant and offshore bank accounts in Cyprus

The merchant bank account is currently one of the most employed types of accounts in Cyprus, as the number of e-commerce companies has grown consistently. It should be noted that a Cypriot online company is required to have a corporate account, as well as a merchant account. Traditional companies can also set up merchant accounts.

The following steps need to be completed when opening a merchant account in Cyprus:

- the company must first select a provider which can install the equipment used for payments;

- the company must file its Certificate of Incorporation in order to set up such an account;

- online companies must also set up a website in order to be able to link the account to the business;

- online businesses must have specific protocols which ensure the safe collection of personal information from clients, in accordance with the GDPR.

Our law firm in Cyprus can help online business owners with the procedure of opening both corporate and merchant bank accounts for their companies.

Offshore companies, whether registered in Cyprus or another country, can have offshore bank accounts opened in Cyprus. These offer multiple benefits, among which enhanced protection of personal information of the owners of the account, but also the possibility of having the account opened remotely. The opening of an offshore bank account in Cyprus takes around 10 days to complete.

Is it possible to open a Cyprus bank account online in 2024?

The Cyprus banking system has undergone various changes for the better in the last few years, and modernization was one of the National Bank’s most important goals which is why it is possible to start the procedure of opening a bank account online.

Foreign citizens and investors interested in setting up businesses in Cyprus can start the opening procedures before arriving to the country. This is an important advantage compared to other European countries in which the procedure is longer, and the foreign citizen needs to be in the country during the entire process.

Services offered by Cypriot banks

There are several services attached to bank accounts in Cyprus. Among these, we can mention online access to the account, the possibility of applying for overdraft in the case of employees of Cypriot companies, the issuance of credit or debit cards depending on the preference of an account holder and many others. It is advisable though to first check with the chosen bank the types of services provided.

The advantages of bank accounts in Cyprus

A Cypriot bank account offers great benefits to its holder. Whether he or she is a natural person or a company, the banking system provides a solution for all types of clients. Some of the major advantages of opening a bank account in Cyprus are:

- a speedy and hassle-free opening process (takes up to 4 days)

- one can submit the documents by fax or e-mail;

- there is no minimum start-up deposit required;

- bank fees are low;

- online banking solution is provided.

Legal framework for banks in Cyprus

The main legal frameworks that regulate banking activities in Cyprus are the Central Bank Law and the Banking Law. The amendments that have been brought to the law since it was first issued in 1997 refer to:

- attract new international financial institutions;

- accommodate conditions for new banks;

- enforce the new EU acquis communautaire;

- implement the recommendations of the Basel Committee regarding the supervision of the financial institutions;

- the change of the national currency to Euro in 2008.

According to the Banking Law in Cyprus a bank is a legal entity enforced by the Central Bank of Cyprus to conduct financial activities under a special license. The main types of financial institutions in Cyprus are public companies, affiliates of foreign banks incorporated as Cypriot private companies, branches of foreign banks, cooperative banks, representative offices of international banks and the Housing Finance Corporation.

The Central Bank of Cyprus

The Central Bank of Cyprus is the main supervisory authority of financial institutions in Cyprus. It makes sure the Cypriot financial system is stable; it supervises payment and makes sure the payment protocols are respected; it collects data about the banking system according to the regulations of the European System of Central Banks. The Central Bank of Cyprus must protect the interests of depositors and minimize the risks of losing their deposits. However, the main objective of the Cypriot Central Bank is to make sure that price stability is accomplished. The Central Bank has also the authority to issue new laws and to enforce penalties whenever the banking system or banking laws have been infringed.

You can also watch our video on how to open a bank account in Cyprus:

Understanding banking fees in Cyprus

Handling fees are among the most common charges associated with bank accounts. For basic accounts, these fees are typically quite reasonable, starting at around 10 EUR per year. However, for premium accounts or those offering additional services like concierge assistance, these handling fees can be significantly higher. Additionally, fees may apply for situations such as overdrawing your account or making cash withdrawals from ATMs.

One crucial fee to consider is the international transfer fee. While this might not be a concern if you primarily use your Cypriot bank account for local transactions, it becomes important if you frequently send money abroad. Different banks may have varying charges for international transfers, so it’s essential to compare these fees.

Assessing banking fees can be complex, but with the assistance of our legal experts, you can choose a bank that suits your financial requirements and objectives accurately.

The development of the financial industry in Cyprus

The financial sector is one of the most developed industries of the country at the moment. Recent statistics indicate that:

- The technology industry is one of the strongest performers, propelling the Cypriot economy forward in 2023 and establishing the nation as a major player in the European market;

- The government has supported the sector and has been striving to improve the business climate for fintech firms;

- According to its third-quarter report, the Cyprus Securities and Exchange Commission (CySEC) monitored the growth of UCIs and management companies to over 300, with a total asset value of €9.9 billion, €3.1 million of which was invested in the fintech industry.

Those who want to open bank accounts in Cyprus in 2024 can choose between various banks, local or foreign, which is why it is worth choosing this country.

The creation of a Cypriot bank account in 2024 is also quite simple thanks to the financial legislation and infrastructure that favor both natural persons and companies. Apart from these, they will also benefit from numerous services attached to their accounts. It could take several weeks to open a local bank account. Your country of origin, how soon you can acquire the necessary documentation, and not ultimately the bank you select are some of them.

If you have any questions on how to open a bank account in Cyprus at the level of 2024, our lawyers will answer them in a very short time.

If you want to set up a company and need advice about the banking system you can contact our lawyers in Cyprus. You can also rely on us for assistance in registering a Cypriot business and setting up the corporate bank account attached to it.